Why You Need Fire Insurance for Your Business

6/6/2022 (Permalink)

Why Does Your Company Need Fire Insurance?

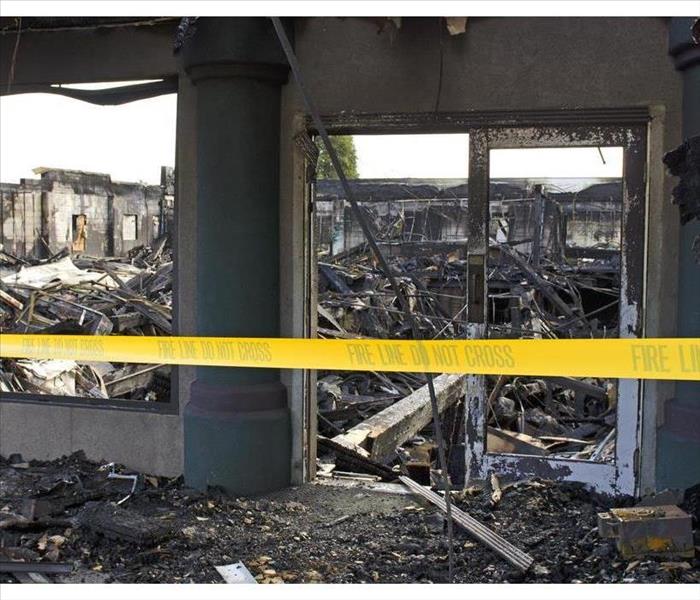

In order to keep your Star Prairie, WI, business running smoothly, your commercial building and property must consistently be in good condition. Factors such as fire damage can wreak havoc on your building and prevent your business from functioning at its best. Investing in fire insurance can help comfort you during a difficult situation and provide your business with an extra layer of security. Here are some of the major benefits of buying insurance to protect your business from fire loss.

Covers Damage

A key advantage of having insurance for your commercial building is that it provides coverage for various types of fire damage. Property damage and loss may be caused by factors such as:

- Flames

- Smoke

- Water

- Powders (from firefighting efforts)

The damage from these sources and others can add up and make fire restoration a more difficult job. Being insured helps to ease part of the process.

Takes Care of Costs

Without fire insurance, the many costs of fire repairs and smoke cleanup may become overwhelming. In addition to repairs, you will have the responsibility of paying for fire department service fees on your own if you aren’t insured. This responsibility can seriously harm your business if you aren’t able to pay for all the costs that are included. Having insurance takes this financial burden off your shoulders.

Gives You Peace of Mind

Dealing with the aftermath of a fire can be an incredibly stressful situation. The last thing you need to worry about is how to cope with the costs of loss and damage to your commercial building. When you have insurance to carry the financial weight of your fire damage, the process of fire restoration can go much more smoothly.

Investing in fire insurance is only the first step towards recovering from a fire in Star Prairie, WI. Be sure to call a professional for a fire damage assessment in order to have your business restored as soon as possible.

24/7 Emergency Service

24/7 Emergency Service